iQoncept/Getty

- Earnings per share (EPS) is a financial measure showing a company's net income per outstanding share, which is calculated on a quarterly or annual basis.

- You can compare a company's EPS to its performance over time – and against its competitors – to better understand how well it's performing.

- But even if you look at a company's EPS trends, you need to dig deeper to understand why its EPS is rising or falling.

- Visit Insider's Investing Reference library for more stories.

A company's earnings per share (EPS) can help investors understand how much money a company makes for each of its common shareholders. Investors can use the ratio to better understand how well a company is performing relative to its competitors and industry. And it's an important input for other financial metrics.

What is earnings per share (EPS)?

A company's EPS shows you how much money the company made for each common share. "A higher EPS indicates better financial health, greater value, and more profits to distribute to shareholders," says AnnaMarie Mock, a wealth advisor at Highland Financial Advisors, LLC.

The EPS ratio is commonly calculated for each quarter and year, and you generally don't want to look at a single EPS ratio in isolation. Instead, consider how a companies' EPS changes over time and compare it to similar companies' EPS.

Why is EPS important?

A company's EPS can be important when you're deciding whether to sell, hold, or buy a company's stock. You can use it to:

- Understand a company's profitability, which may impact its dividends and stock price.

- Calculate the company's price to earnings ratio (P/E ratio), which measures its stock price relative to its EPS.

- See if the company's profits are growing or declining over time.

- Compare the company's actual EPS to analysts' expectations.

- Compare the company's EPS to direct competitors' EPS.

But there's no single number that represents a "good" EPS – it's all relative.

"EPS can vary greatly from one industry to another, so a good EPS is dependent on the company and expectations for future performance," says Mock. "It's better to compare the EPS for similar companies as the interpretation can be subjective otherwise."

How to calculate EPS

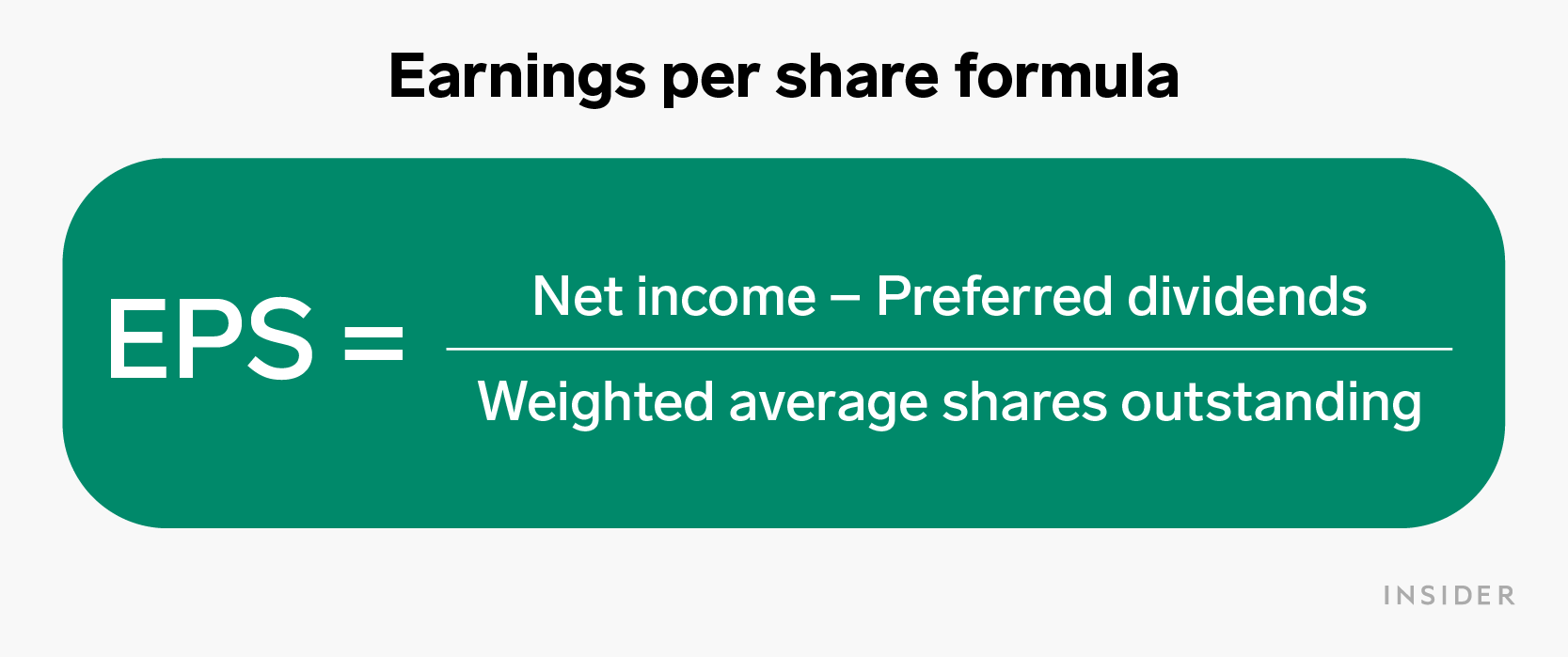

The basic EPS calculation is fairly simple, although several variations can lead to different results.

First, subtract the company's net income (i.e., net profit) from its preferred dividend payments for a specific period - usually a quarter or year. You remove the preferred dividends because EPS shows the earnings for common shareholders only.

Then, divide the result by the weighted average number of shares outstanding during the period. Sometimes, the number of outstanding shares at the end of a period is used. But the weighted average can be more helpful because companies commonly issue or buyback shares.

The EPS formula

As an example, consider Company X, which made $750,000 in net income and paid $80,000 in preferred dividends during the previous year. The numerator is $750,000 - $80,000 = $670,000.

Company X had 200,000 outstanding shares for the first six months of the year and 250,000 outstanding shares during the second half of the year. The weighted average shares outstanding is 225,000.

The basic EPS is $670,000 / 250,000 = $2.98

You can find the relevant numbers in public companies' quarterly and annual reports. Or, you can simply look for the company's EPS on its income statement.

Basic EPS vs. diluted EPS

There are several EPS calculations that investors may want to use when researching a company. Two common ones are the basic EPS (what's described above) and diluted EPS.

"Unlike the basic formula, this includes convertible securities, like preferred stock and stock options that can be 'converted' to common stock at any point in time," explains Mock. "Because there is the potential to have more securities included as common shares, the total number of outstanding shares increases and, in turn, lowers the EPS."

|

Basic EPS |

Diluted EPS |

|

|

Public companies are required to report both their basic and diluted EPS, when relevant, in their public filings.

What EPS might not tell you

Knowing a company's EPS can be helpful when you're investing, but it's only one piece of the puzzle.

For one thing, the EPS doesn't take the current stock price into account. Perhaps the company is performing well, but the price is so high that it's currently overvalued and a poor investment.

Basic and diluted EPS calculations also overlook how an extraordinary income event or expense impacted the company's finances.

For example, a company might make a large one-time sale that leads to a high EPS for a quarter or year. However, if the company can't repeat the sale, the increased earnings aren't sustainable. An adjusted or normalized EPS calculation will show the company's EPS after removing one-time events and seasonal changes from a company's earnings.

Even if you look at EPS trends, you need to dig deeper to understand why a company's EPS is rising or falling.

EPS might go down as a company increases research and development spending - which isn't necessarily a bad long-term move. Research-intensive tech and pharma companies might have negative EPS, but they could offer good growth stock opportunities. On the other hand, increasing EPS can also be due to a variety of changes, including increasing sales, share buybacks, and decreasing costs.

The financial takeaway

The EPS can help you understand whether the company's profits are increasing or decreasing over time. But you want to understand the context and industry.

"Looking at EPS alone does not provide the whole picture," says Mock. "There are many factors to incorporate when reviewing a potential investment, including future inflation projections, interest rates, and market sentiment."

You shouldn't ignore a company's EPS - especially in relation to its previous performance and competitors. Instead, use it as one of the many screening criteria you consider when making investment decisions.